This year, you’re going to master fraternity software basics so you can build and manage your chapter budget like a pro. Whatever budgeting blunders you’ve made in past semesters, esteemed chapter treasurer, fret not—there’s good news ahead. 2020 is the beginning of a whole new decade.

Now’s the time to make our resolutions. To unburden ourselves from bad habits and build a new, better foundation for the future.

It’s a time for your fraternity chapter to look back one last time before turning to the fresh path before you.

You can facilitate this change by taking a cold, hard look at the numbers in your budget, and making every dollar count toward a bright new tomorrow for brothers. One crucial tool in fulfilling this endeavor is OmegaFi’s premium chapter budgeting software: Vault.

Explore How Vault Can Help Your Chapter Budget Better Here.

The right software paired with the right habits will help you manage financial success for your chapter, and that’s worth lighting up the fireworks.

In this blog, we’ll cover:

- Square One: How Is Your Fraternity Chapter Budgeting Now?

- Better Fraternity Budgeting for the New Year.

- Budgeting Software Basics: Making the Move to Vault.

So let that ball drop, because we’re about to celebrate. Here are our Fraternity Software Basics for Better Chapter Budgeting in 2020.

Square One: How Is Your Fraternity Chapter Budgeting Now?

The first step to moving forward with better financial management is to look at your chapter’s current budgeting habits.

Here are a few key areas to examine with your executive committee and advisors.

New Treasurer Education

If your chapter constantly must dig its funds out from the red, chances are these bad habits stem from your new treasurer transition process. Identify weak spots and bad habits in your budgeting and financial management process. Then go back to your new officer transition process and add more emphasis and training in those areas.

Talk with chapter advisors about how to better prepare new treasurers. Interview current and past treasurers if necessary. Ask them where they feel their weaknesses are, or were.

Where Are You Over and Under Budget?

Over the course of several semesters, where are the common snags in your budget? Are you consistently putting too little money toward certain areas? Are you putting too much priority on socials, or spending lavishly on non-essentials, when you could be dedicating more to budget items like recruitment, academics, retreats, philanthropy, etc.?

Are you covering your operational expenses and other fees? Which chapter projects are essential and must be paid for this semester? Which can or should wait? Identifying key problem areas in your budget can help you plan better in the future.

Membership Dues Collection and Money Management

How many brothers pay their dues on time or in advance? How many are late? How much is in collections or have you had to write off? Which brothers are on payment plans, and which are paying their dues with a chapter scholarship?

What kind of process do you use to collect dues? How do you document outstanding dues?

Do you use fraternity software for managing chapter finances?

How do you communicate with brothers? Emails? Chapter announcements? Printed receipts? Do you have an incentive program to encourage brothers to pay? What’s working, and what isn’t?

Take a close look at your chapter banking process, how you track these transactions, and how often you cut expense checks for brothers. Were there times you gave in and let brothers expense meals or other costs you shouldn’t have?

How are you tracking your budget currently? A spreadsheet? A ledger? Does your chapter have a specific formula you have to follow, and is it consistent semester to semester?

Better Fraternity Budgeting for the New Year

Now that you’ve been brutally honest with yourself about the good, the bad, and the (hopefully not) ugly sides of your budgeting, it’s time to build better practices for 2020 and beyond.

Here are a few steps toward better budgeting in the new year.

- Focus on getting your coffers out of the red. Make hard decisions together, and cut nonessentials when necessary. Make shortfalls and potential debts a top priority. Strategize ways to transition toward creating a surplus/savings.

- Collect outstanding dues. You can build the perfect budget, but it won’t mean much if you have a bunch of outstanding membership dues. Pull out every stop to get brothers to pay. Put your foot down. If they want to keep attending events, wearing your letters, and remaining active members, they must pay up.

- Educate your membership. Aside from building a more effective new officer training program for your treasurer, you can also educate brothers about the budget process and what their dues pay for. Remind them of the benefits of paying and the consequences of delinquency. Hold educational seminars to discuss personal financial responsibility and good money management habits.

Budgeting Fraternity Software Basics: Making the Move to Vault

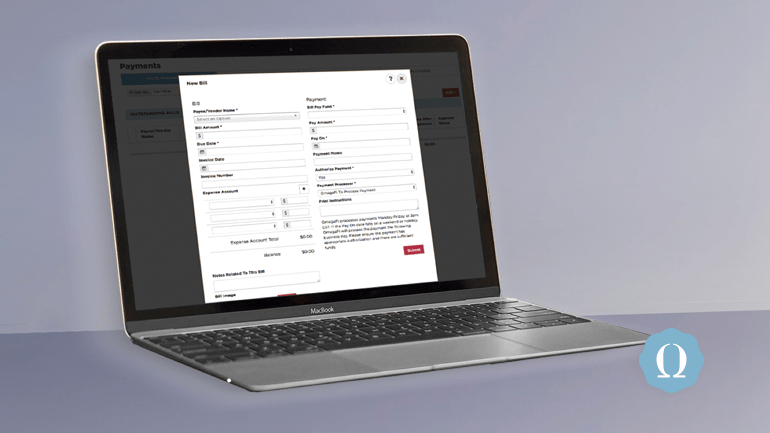

Vault budgeting software is designed to give you all the tools you need to budget more effectively, more consistently, and more intuitively.

Here are a few of Vault’s functions that’ll help your chapter budget better from day one:

- Build and manage your budget with the help of OmegaFi’s financial experts.

- Invoice members and collect membership dues and other fees electronically.

- Track financial reporting.

- Manage and pay chapter bills.

- Linked VISA Card.

OmegaFi also offers other budgeting software solutions. Use LegFi for a lighter, more self-serve budgeting and dues-collection experience. Invest in VaultPro for a complete, advanced financial management suite with help from an assigned account representative.

OmegaFi offers software solutions for Greek chapters for recruitment, budgeting, communication, and more. Learn more about our services or call direct at 800.276.6342.

What are your chapter budget New Year’s resolutions? Let us know in the comments below!